Forex Trading Technique Guide: Strategies and Examination

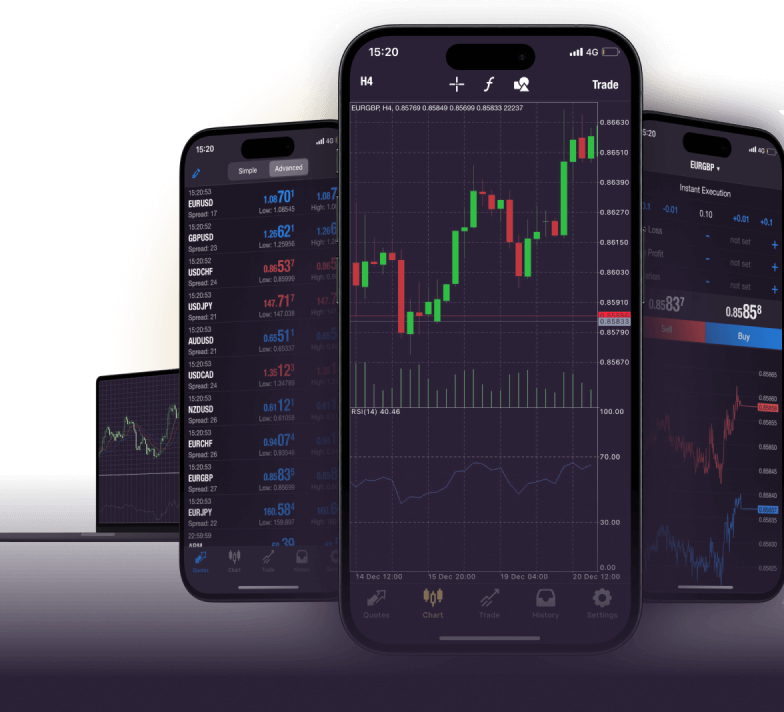

Advanced CFD trading instruments are logical and delivery assets designed to increase decision-making within how to trade mt5 for beginners tools review markets. These tools support traders interpret price action, calculate market conditions, and respond to changes faster. Relating to application data, traders who incorporate sophisticated methods to their workflow tend to obtain larger reliability and sharper performance insights than those relying only on basic information observations. Which charting abilities are important for CFD analysis? Modern systems offer multi-dimensional charting features that enable traders to see value movements across various periods. Resources such as for example tailor-made candlestick patterns, move features, and split indicators offer deeper market context. Information from efficiency reviews suggests that traders using advanced graph adjustments tend to be more effective at distinguishing development changes and possible change areas, increasing trade time accuracy.

How do technical signals help CFD decision-making? Complex signals break up fresh cost data in to actionable signals. Tools like moving averages, oscillators, and volatility procedures are widely used to determine energy and trend strength. Mathematical evaluations show that after traders mix complementary indicators—such as a trend-following software with a push gauge—the likelihood of confirming trusted signs increases. That layered strategy decreases the likelihood of fake numbers and promotes proper planning. What role do alert and automation methods play? Alert systems notify traders of substantial industry functions or value changes predicated on predefined criteria. Automated triggers, accomplished without handbook treatment, let regular responses to growing conditions. Business data implies that traders using alerts respond up to 30% quicker to crucial signs compared to manual checking, contributing to more disciplined execution and paid down missed opportunities. How does efficiency monitoring lead to improvement? Efficiency tracking tools compile comprehensive logs of trading task, including win costs, average results, and drawdown periods. Mathematical examination of trader habits reveals that standard performance evaluation correlates with measurable development over time. Traders who analyze their famous information systematically may modify techniques more effectively, leading to better outcomes and increased psychological resilience.

Do risk examination functions help with CFD trades? Yes—sophisticated chance analysis functions estimate cases such as potential reduction predictions and position exposure. Studies claim that traders who regularly use risk measures to plan items and leaves tend to maintain tighter get a grip on around capital allocation. That disciplined strategy decreases inconsistent conduct and helps long-term efficiency stability. May simulation and backtesting tools increase strategy quality? Simulation and backtesting tools allow traders evaluate methods against historic market data. Performance metrics from backtesting support assess estimated outcomes and refine access criteria. Research indicates that traders who check their techniques before live arrangement achieve larger confidence and make fewer reactive choices under pressure. Conclusion Advanced CFD trading resources are crucial for in-depth analysis and proper refinement. From superior charting and indications to attentive methods and performance trackers, these resources help traders understand complicated areas with greater clarity. By leveraging data-driven insights and disciplined delivery, traders can achieve more consistent efficiency and improved choice quality.